Join Our Breakfast Meeting on May 29th

JP Morgan CEO Jamie Dimon:

We’re in “most treacherous times”

Are you ready for economic Armageddon?

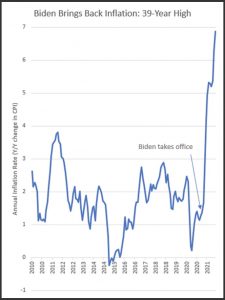

To no surprise, Jerome Powell recently said that the Fed still doesn’t have inflation under control. In fact, the Federal Planning Bureau is now admitting that inflation will continue to increase through 2025. This is exactly what Victor Reed warned us about when he spoke to our group last year. Since then, inflation, interest rates, and gold prices have skyrocketed, and Goldback values have risen more than 25%.

To no surprise, Jerome Powell recently said that the Fed still doesn’t have inflation under control. In fact, the Federal Planning Bureau is now admitting that inflation will continue to increase through 2025. This is exactly what Victor Reed warned us about when he spoke to our group last year. Since then, inflation, interest rates, and gold prices have skyrocketed, and Goldback values have risen more than 25%.

Even left-controlled federal agencies admit that inflation isn’t stopping anytime soon, and the stock market bubble primed to burst.

What do you need to do NOW to minimize the damage to your finances, your business, and your family?

Even if Trump takes office in January next year and implements radically conservative fiscal policies, we won’t begin to see the effects upon the economy until 2027. But this assumes fair elections, Congress being cleaned out, and no more plandemics. What to do to protect yourself?

Back by popular demand, Victor Reed will disclose the latest revelations proving that our republic has been subverted such that even lawfully conducted elections won’t save us. Thankfully, he will also provide a way out, with immediately actionable solutions designed to reduce the impact of the coming economic Armageddon.

Come to hear more, come learn how to protect your family from the much-warned economic collapse. Sign up today!

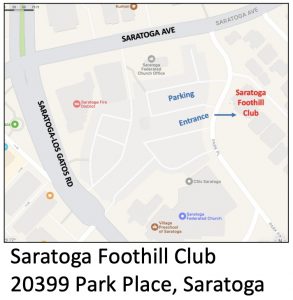

Date: Wednesday, May 29th

Time: Check in begins at 8:30 AM — Breakfast served at 9:00 AM,

Cost: $25 for non-members, $20 for members, FREE to Premium Members (Reagan and Sponsors)- Cost includes buffet breakfast.

Stroll the grounds and enjoy the 1915 Arts & Crafts style building designed by world-famous architect Julia Morgan, who also designed Hearst Castle.

Stroll the grounds and enjoy the 1915 Arts & Crafts style building designed by world-famous architect Julia Morgan, who also designed Hearst Castle.